There was a time when digital transformation was simply a buzzword. There’s no doubt that those days are long gone. According to Gartner, digital transformation (DX) is set to support 36% of overall revenue by 2020 and IDC predicts worldwide spending on DX will reach a cool $1.97 trillion in that same year.

With digital transformation causing an industry-wide shakeup, the financial sector has been no exception to extreme disruption. Accenture’s latest report on digital transformation in financial industry capital market firms found 93% of technology executives are investing in long-term plans for digital innovation, all sharing the viewpoint that they expect technology’s influence to grow over the next three years.

Carrying a strong emphasis on future proof solutions within the banking and financial services sector, the report also revealed big investments are being made in analytics, automation, robotics, cloud technologies and data. For instance, more than 90% of respondents say that within five years, virtual assistants will handle more than half of customer interactions, and 87% predict that blockchain will become the source of business-to-business (B2B) financial transactions.

This arms race to digitize financial services business models has been very much fuelled by two main factors. Firstly, the rise of challenger companies - digital in nature, free from the shackles of legacy systems and modeled on much lower operational costs, have instigated a game of tech catch up, raising the bar for innovation while stealing market share from traditional players. In the UK for instance, the market share for current accounts for the four big legacy banks has dropped from 92% a decade ago to around 70 percent today.

Read next: Where is your enterprise at with evergreen IT?

Add to this rapidly changing demands of the customer. Deloitte’s 2018 global consumer survey on digital banking concluded that today we expect financial service providers to act like our favorite brands such as Apple, Amazon and Google to deliver a seamless user experience at lightning speed. When payments can be made in a few clicks or a credit card applied for on your commute via a mobile phone, tedious processes such as waiting in line at branches and appointments with financial advisors have become increasingly undesirable and monolithic.

While you’d be hard pushed to find a bank or financial services firm that doesn’t realize they’re operating in a highly competitive, digitize or die market, the challenges of successful implementation of digital transformation in financial services are widespread. Particularly for legacy-based and large-scale enterprises, future proofing solutions for digital transformation is becoming a growing concern and priority. In fact, one-third of financial services CIOs have identified digital as their top business priority for 2019, up by more than 8% from 2018.

To explore these challenges, we’re taking a look at how leading brands are approaching digital transformation in banking and financial industry sectors to find out who’s doing it well and what we can learn from their successes.

Mobile first, big data second.

Last year in the banking sector alone, it was estimated that $9.7 billion was spent enhancing digital banking capabilities. As online and mobile channels became more and more relevant to consumers (for example, Bank of America currently receives more deposits from its mobile channel than it does from its branches), the switch to digital has been increasingly visible, particularly on our highstreets. In the UK it’s estimated that 60 branches close each month, with banks opting to shift resources into migrating business to its digital space.

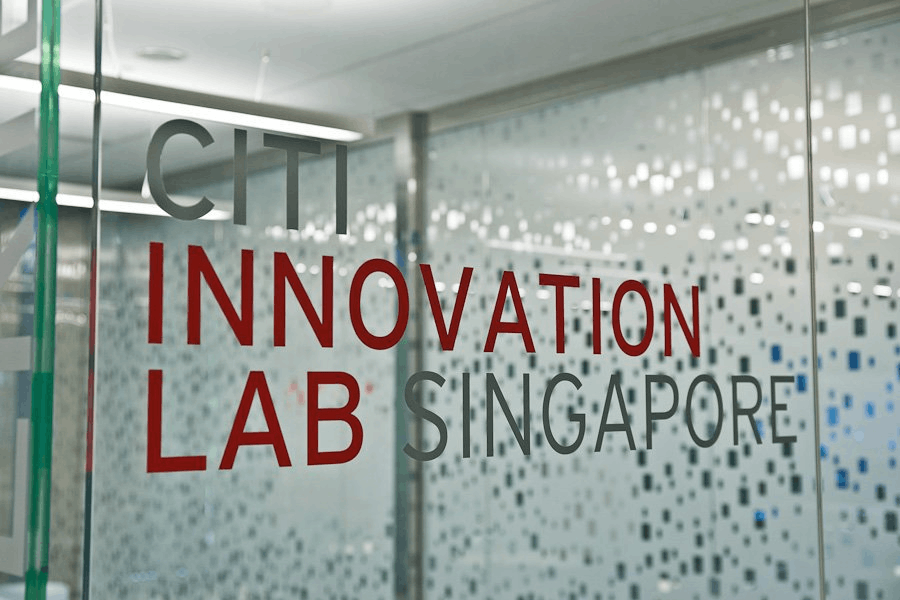

American banking group Citibank, which currently holds the title of The World’s Best Digital Bank, was very much at the forefront of this movement. Activating its mobile-first strategy launched several years ago, the company shut down branches in even its fastest growing markets to cut operational costs and shift resources from stores to internal digital investment in cloud computing, analytics, automation and machine learning.

Powered by Citi’s digital lab, the move positioned the group ahead of the game for digital transformation in financial industry activity. Its infrastructure not only delivered on customer demand for online products, but it also enabled the company to gather intelligent data from its digital channels. The more data Citi gathered - whether from digital advertising, smart e-commerce partnerships or site traffic, the bank could use its insights to target and retain its ideal customers more effectively.

Investing in digitizing its internal structure rather than spending budget on the traditional bricks and mortar offering favored by its competitors, has become fundamental in allowing the Citi team to continue to innovate. Whether that’s becoming the first financial services app on the Apple Watch to launching banking services on social media applications such as Facebook Messenger.

As Deloitte stated in their 2019 Tech Trends Report, “every company is now a tech company” and as demonstrated by Citi, internally it pays to think and act as both a tech company and a financial services brand.

Securing buy-in

Spearheading Citi’s digital transformation was Head of Operations and Technology, Don Callahan. Speaking of his team he told an interviewer: “it doesn’t operate like a traditional bank; it is much more like a creative team... I’m seeing the speed, the curiosity, and the execution at levels I’ve never seen before.”

Encouraging a culture of digital-first, technical innovation throughout the business is a huge stumbling block to many organizations’ digital transformation in banking and financial industry efforts. According to Accenture’s report ‘Capital Markets: The Digital Opportunity for Improved Competitiveness’, “many capital markets firms suffer from a pervasive lack of buy-ins for digital transformation” - with more than a quarter stating lack of executive support stands in the way of technology innovation. For retail banks this buy-in is as low as 17%.

This traditionalist attitude filters down. 30% of those interviewed by Accenture claimed a lack of employee support for digital transformation is an obstacle at their firm. It’s hardly surprising then, that change of management came top of the list of challenges capital markets firms face for realizing ROI in digital transformation in banking and financial industry investments.

The Accenture report also points to the success story of Schroders. Among its digital initiatives, the global investment management firm experienced significant results by applying AI and machine learning for digital transformation for operational efficiency. Time previously spent on manual, repetitive tasks was freed up, allowing employees to focus on higher value work such as performing data analysis daily rather than monthly.

The automation of manual tasks has become a huge tech trend for 2019 and proven to be a major strategy for digital transformation in banking and financial services. Internal operations at the award-winning Bancolombia, for instance, were supercharged when within the first year of its robotic processing automation project it automated 40 business processes, translating into $1.4 million reduction in operational costs and $7.5 million in income.

However, Schroders’ digital transformation only happened three years ago when its CTO and CEO came to a shared vision of the firm as a “technology- and data-led company”. This is, as CTO Stewart Carmichael surmises “the new paradigm of our industry”, having buy-in from the very top and cultivating a new mindset when it comes to technology and digital transformation goals.

Being more Monzo

The driving engine behind the digital transformation in banking and financial industry movement, was certainly the posterboys of the fintech revolution - the digital-only banks such as Starling Bank, Revolut, Atom and N26.

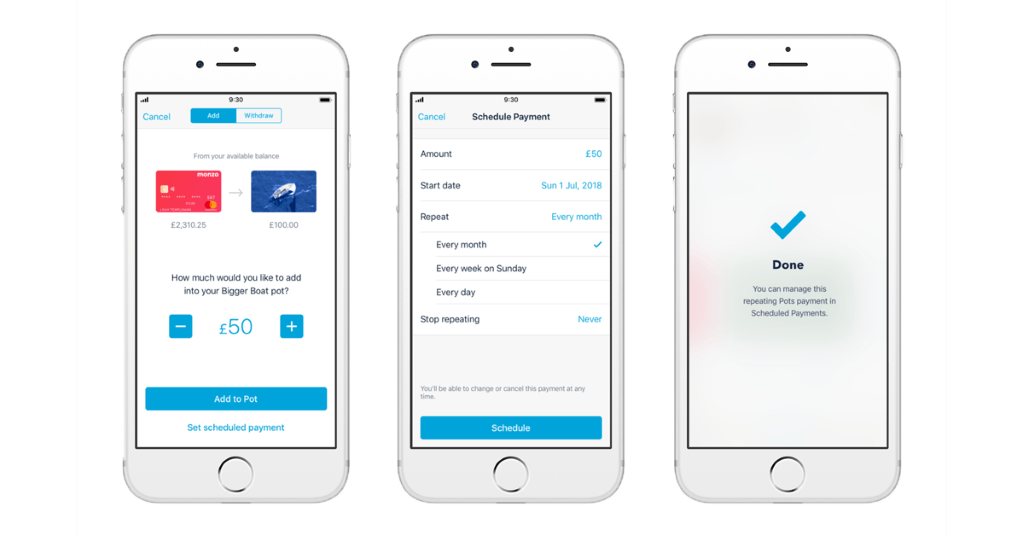

A huge player in the sparking of the urgent and widespread need for change was Monzo. Characterized by its millennial colored cards, Monzo is currently the UK’s biggest digital only bank with over one million customers and plans to double its value to £2bn with an imminent US expansion.

In a recent interview with Wired Magazine, Andrew Wu, Assistant Professor of finance at the University of Michigan, pinpointed a key factor to Monzo’s success - its investment in APIs from the get-go:

There are two major takeaways we can learn from Wu’s observation of Monzo’s pairing of its bank end with front end offerings varying from visual breakdowns of budget spend to 24/7 customer service and online community forums.

Firstly, there’s Monzo’s focus on ensuring its entire ecosystem is connected and designed to work seamlessly - tried and tested with its infamous waiting list and trial roll-outs. This is an area in which most capital market firms struggle. In addition to buy-in issues, Accenture’s study found that more than a third of capital market firms find a lack of system integration or compatibility as a top-three obstacle to achieving desired results from technology investments at their firm. Now more than ever, companies need to ensure their ecosystem can accommodate new and experimental tech.

Secondly, while 83% of investment firms say they pay close attention to the tools and platforms used by direct competitors, Monzo’s success in the digital transformation in the banking and financial industry game shows you need to be looking beyond your competitors. If, like Monzo, capital market firms had paid closer attention to developments in the tech sector rather than the financial services industry, the story of the online banking scene could have looked very different.

Gartner’s 5 Digital Transformation Identities of Financial Services Organizations is a great read for more information on the benefits of thinking more like a ‘Digital transformer’ (currently only 12% of financial service organizations fit this category) compared to a ‘Traditional Business’ - but in essence, companies who think outside the box and proactively seek inspiration beyond the everyday and industry norm, are the ones that will be leading the pack for forward-thinking innovation.