Eliminate compliance risk with insurance automation software

Struggling to scale compliance and consistency across teams and borders?

Templafy’s AI-powered automation stops document delays, makes sure every file meets regulatory standards, and keeps your brand consistent across all teams—all from inside the tools you already use.

“The biggest benefit of using Templafy has been the improved quality of our documents and the time saved. Quick, easy document creation allows employees to focus on more important tasks, saving time and money.”

Anna Andersson-Solja

Marketing Project Manager, Business Area Industrial, If P&C Insurance

The cost of manual document workflows

Your teams’ time is too valuable to waste on tedious document tasks. Yet your most skilled insurance professionals spend their days hunting for templates, wrestling with formatting, and fixing compliance errors. Here’s what’s really at stake when your teams rely on manual document creation:

| Pain point | Business impact |

|---|---|

| Human error and typos | Compliance risks and reputation damage |

| Version chaos and outdated templates | Regulatory penalties and audit failures |

| Manual approval bottlenecks | Delayed claims and frustrated customers |

| Security risks from mismanaged files | Data breaches and unauthorized access |

| Wasted time on formatting and searches | Reduced productivity and higher costs |

| Missed deadlines from slow processes | Lost deals and competitive disadvantage |

| Rising operational costs | Budget strain from inefficient workflows |

Turn compliance chaos into automated certainty across every insurance document

Templafy transforms disconnected document workflows into streamlined, automated processes that save your teams time while protecting your brand.

With AI-powered automation built into Microsoft 365 and your existing systems, every document automatically meets brand standards and regulatory requirements. This turns document creation from an operational bottleneck into a competitive advantage that drives revenue and customer satisfaction.

Five reasons why insurance teams need Templafy

- Stop claims from getting stuck: Automate intake and approvals so claims move forward without delays.

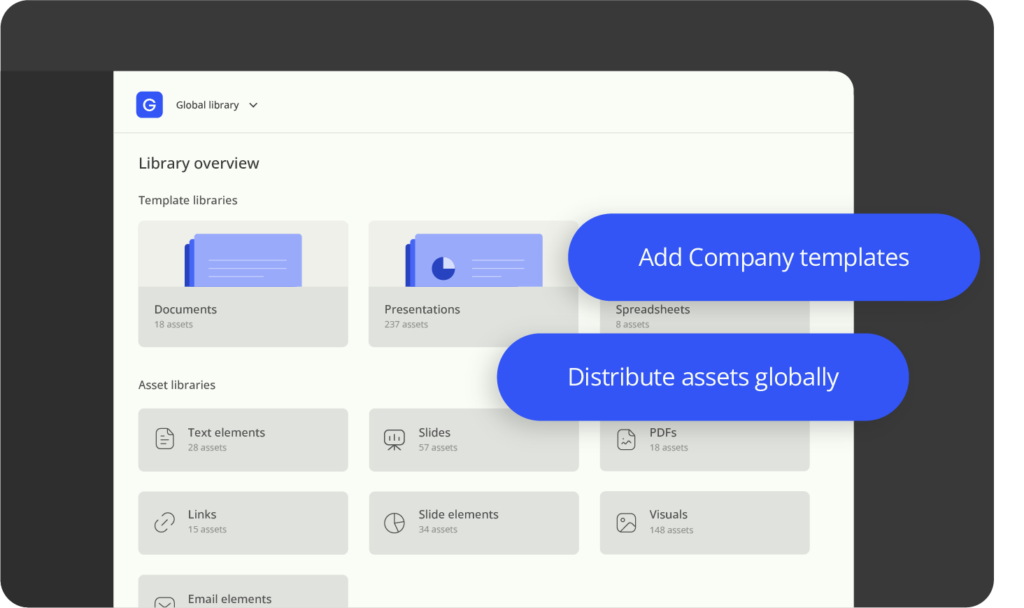

- Keep every document on-brand: Centralized templates make sure every policy and client email looks consistent.

- Roll out policy updates faster: Push regulatory changes company-wide with centrally controlled updates.

- Respond to customers instantly: Create on-brand, compliant communications right inside Word and Teams.

- Catch compliance errors before they happen: Build regulatory guardrails into every document to avoid costly mistakes

Features that keep you compliant and on-brand, effortlessly

Smart document templates

Templates adjust automatically to your brand and rules, based on location and user.

CRM integration

Pull data from your systems so documents stay accurate, on-brand, and up to date.

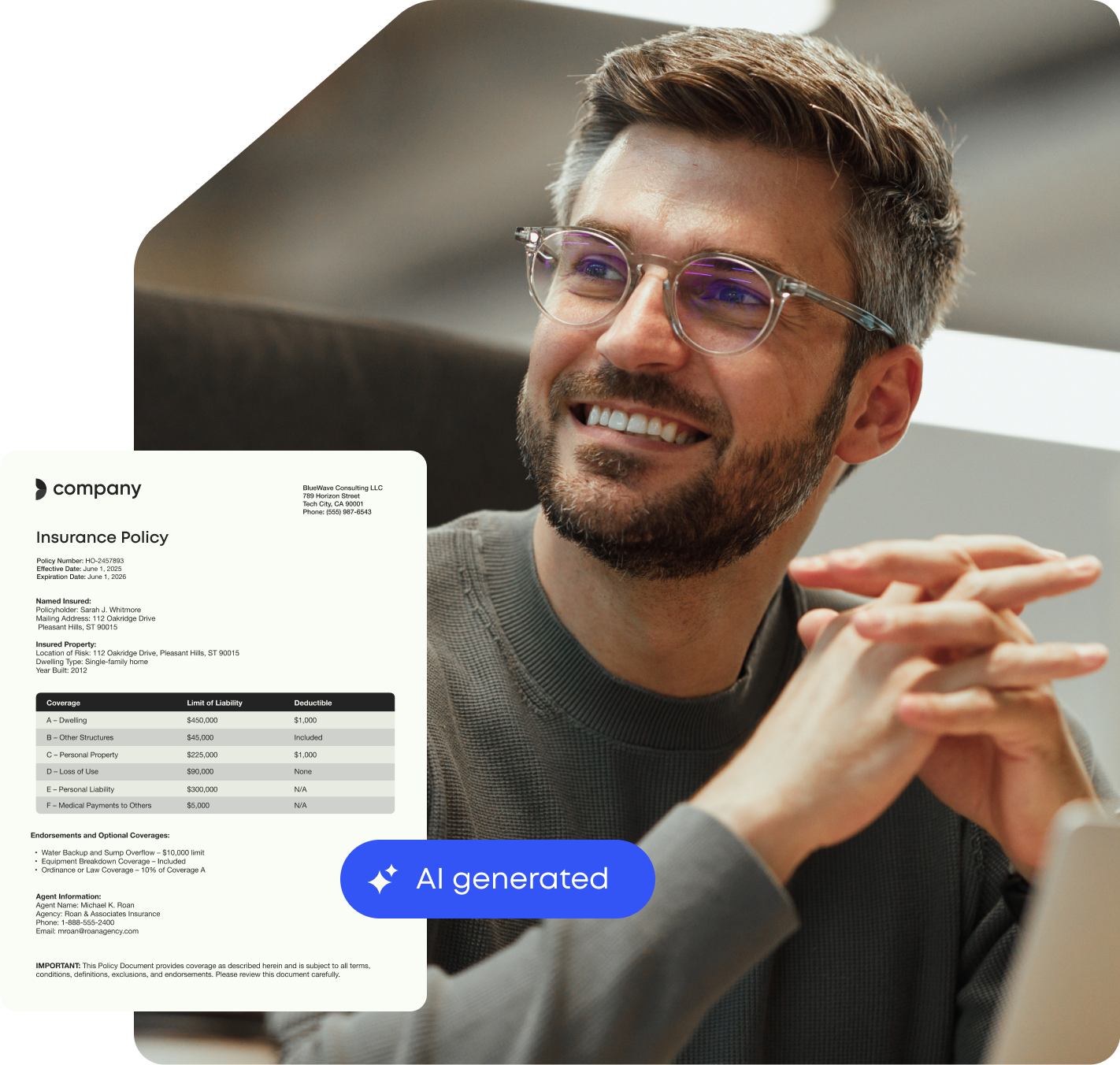

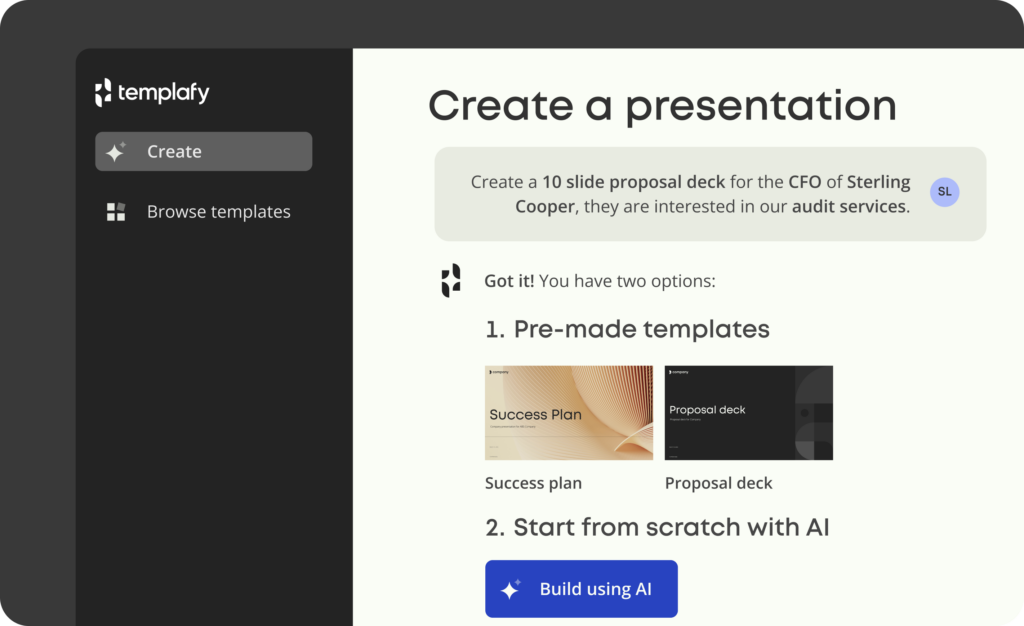

Enterprise-grade AI

AI helps create content that follows your brand and compliance rules every time.

Access controls for compliance

Control who can edit documents to keep sensitive information secure and compliant.

Metadata-driven automation

Update content once and watch it refresh across all your documents automatically.

Audit trails and content logs

Keep track of every change and action for complete visibility and audit readiness.

How Templafy automates critical insurance workflows

Templafy embeds compliance controls and brand standards directly into your existing workflows. Here’s how leading insurers are transforming their operations:

Claims processing

Claims processing

Templafy connects to your systems to pull claim data, generate assessment documents, and route approvals automatically—helping you close cases in hours instead of days.

Document compliance and reporting

Document compliance and reporting

Every document gets automated disclaimers, audit trails, and content controls. When regulations change, updates deploy across all templates instantly.

Onboarding and client communication

Onboarding and client communication

From welcome packs to renewal reminders, Templafy’s approved templates ensure every touchpoint looks professional and meets regulatory requirements—building trust from day one.

Policy generation and renewals

Policy generation and renewals

Templafy’s smart templates roll out regional clauses and pricing updates instantly, cutting hours of manual rework and minimizing compliance risk—so you can focus on growth.

Compare Templafy to other insurance automation platforms

Where most solutions stop at basic document assembly or template management, Templafy delivers secure, end-to-end workflow automation. It embeds compliance, brand standards, and regulatory controls into every step of the document lifecycle.

Because Templafy works natively within Microsoft 365 and connects with your existing systems, your teams can move faster without compromising control. You get the speed and efficiency of automation, the oversight compliance demands, and the consistency your brand requires, all in one place.

Here’s why leading enterprises choose Templafy.

Complete workflow automation

Automate every step, from document creation to compliance, so nothing is missed along the way.

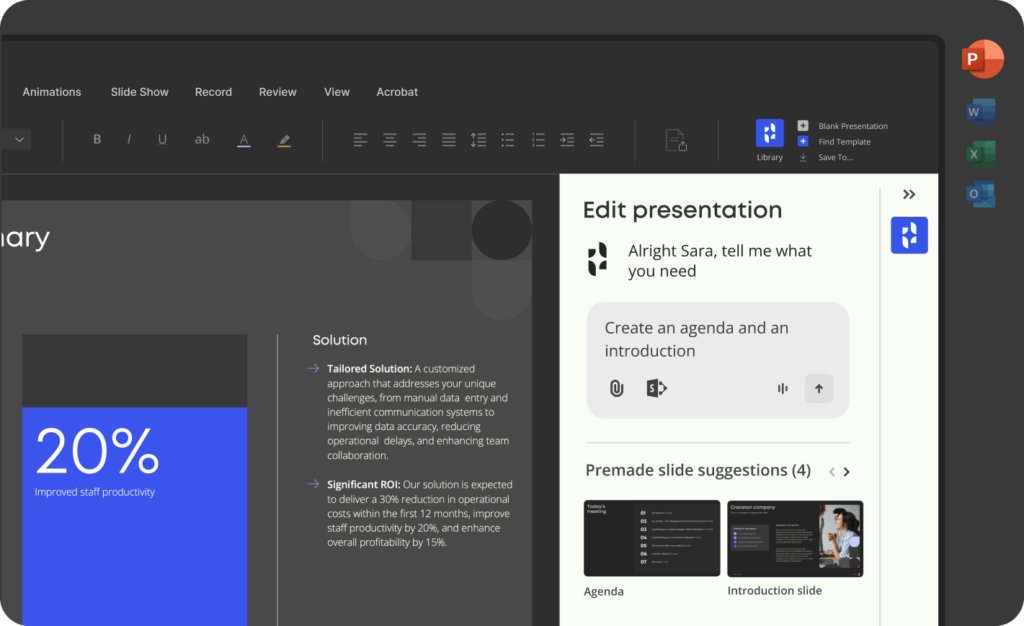

Native Microsoft 365 integration

Work directly inside Word and Outlook, with no extra logins, switching tools, or training required.

Enterprise-grade AI

Use AI confidently to speed up work, with full control over compliance, security, and brand consistency.

Scalable, centralized governance

Roll out updates and enforce standards across every team, business unit, and region, instantly and accurately.

Proven ROI with global insurers

See measurable improvements in document speed, accuracy, and compliance, backed by real results from leading insurance companies.

customer case

How If P&C Insurance improved accessibility and document quality

If P&C Insurance is a leading property and casualty insurer serving over 3.7 million customers across 11 countries. With 6,500 employees creating thousands of documents daily, they needed a solution that could ensure brand consistency and regulatory compliance at scale.

The challenge:

Different offices had their own approaches. Employees created templates with random images, stored documents locally, and often relied on external agencies to apply brand styling, leading to delays and version control issues.

The transformation:

Templafy gave If P&C a centralized hub where employees could access up-to-date, compliant templates and pre-approved content. Teams were empowered to create and update documents themselves, without needing to outsource branding.

The results:

| Before Templafy | With Templafy |

|---|---|

| Inconsistent branding across 11 countries | Centralized templates ensure brand consistency |

| Manual, time-consuming creation | Dynamic templates and content libraries save hours daily |

| Dependency on external agencies | Employees create and update documents internally |

| Compliance risks from outdated templates | Instant updates deploy to all users simultaneously |

| Confusion around brand guidelines | Pre-approved content is always available in one dashboard |

Frequently asked questions

What’s the difference between RPA and workflow automation?

RPA (Robotic Process Automation) automates individual, repetitive tasks like data entry, form filling, and file transfers. It works well for simple, rule-based activities.

Workflow automation manages complete end-to-end processes involving multiple people, systems, and approvals. It coordinates entire workflows from start to finish.

Where does Templafy fit in workflow automation?

Templafy is designed for comprehensive workflow automation. Our platform orchestrates document creation, review, and approval processes while connecting to your existing insurance systems. We handle the complex document workflows that RPA alone cannot manage, ensuring every step maintains compliance and brand standards.

How does Templafy ensure regulatory compliance?

Templafy embeds compliance controls directly into every document template. Required disclaimers, legal terms, and audit metadata are automatically included based on document type and location. When regulations change, updates deploy instantly across all templates, keeping your organization compliant without manual intervention.

Can Templafy integrate with our existing insurance systems?

Yes. Templafy connects directly with Microsoft 365, Salesforce, and most major insurance management systems. This means your teams can create compliant documents without switching platforms, and all data stays synchronized across your tools.

Is Templafy secure enough for sensitive insurance data?

Yes. Templafy is built to meet enterprise security standards, including ISO 27001, ISO 27017, SOC 2, SOC 3, Microsoft 365 App Certified and GDPR compliance. We offer role-based access controls, full audit trails, and encrypted data handling to keep your sensitive documents secure.

Ready to speed up every policy, claim, and renewal?

Book a live walkthrough to learn how AI-driven templates remove manual steps and free your team for higher-value work.