AUTOMATED REGULATORY REPORTING

Guaranteed accuracy and security for every reporting line

Minimize risk and streamline regulatory reporting with compliant automation.

Not another heavy RegTech system

Most regulatory technology providers promise full-stack reporting platforms. The reality? They are complex, costly, and often sit outside the tools your teams already use.

Templafy works as a layer inside your existing workflows, embedding compliance directly into every document and report as it is created. That is where most errors, risks, and inefficiencies begin.

With document-level governance, you get accuracy, compliance, and audit readiness built in from the start, without adding another heavy system to manage.

“Last year, we generated over 120,000 documents through Templafy, saving us about $1.65 million.”

Brion Hendry

Partner and Assurance Innovation Leader, BDO Canada

What is regulatory reporting automation?

Regulatory reporting automation uses software to handle the creation and delivery of required compliance reports.

In industries like banking and insurance, manual reporting takes time and often leads to mistakes that put organizations at risk.

Automation makes reports faster, more accurate, and always audit-ready.

Why automate regulatory reporting?

Reduce risk of non-compliance

Today

Regulations change constantly, but updating templates and approved assets is slow and irregular.

With Templafy

Templates update automatically with the latest rules, so every report is accurate and compliant.

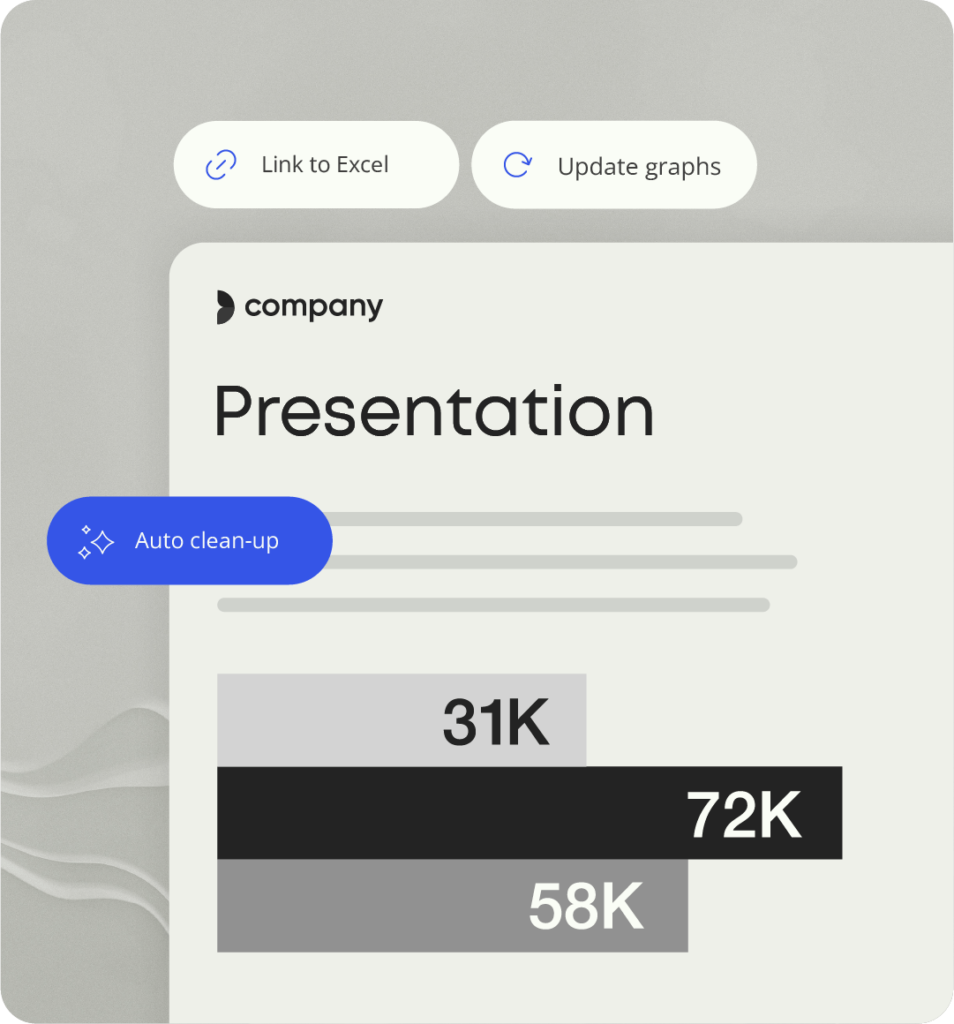

Improve efficiency and accuracy

Today

Manual data entry slows teams down and increases the risk of mistakes.

With Templafy

Reports populate directly from trusted data sources, reducing human error and saving hours of prep work.

Scale reporting effortlessly

Today

Meeting growing compliance demands often means adding headcount or outsourcing.

With Templafy

Automation scales with your business, keeping reports consistent across markets and jurisdictions without extra resources.

How Templafy makes regulatory reporting faster, safer, and audit-ready

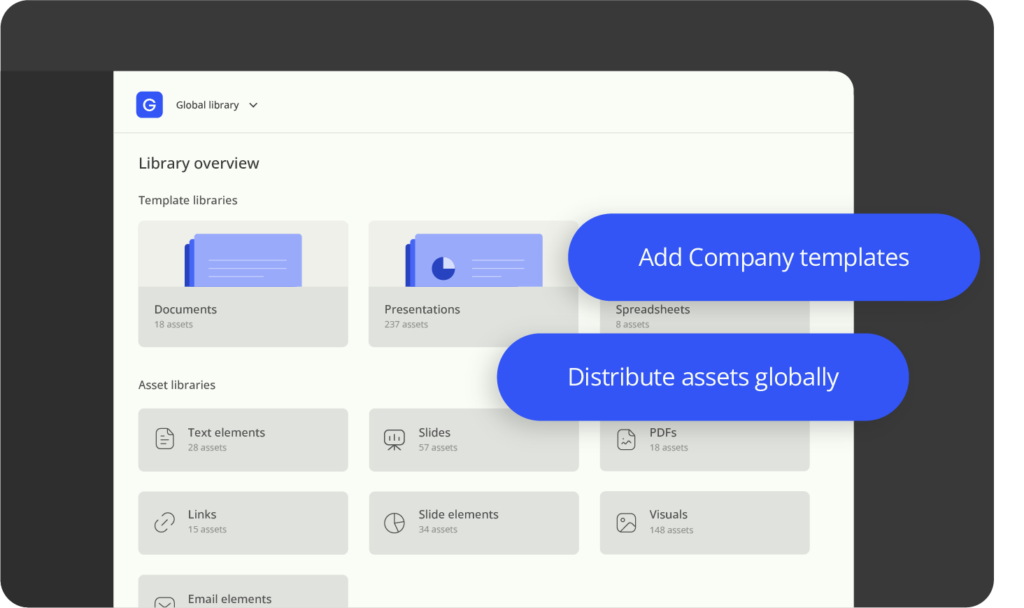

Centralized template management

Keep every report accurate with universal access to updated, compliant templates.

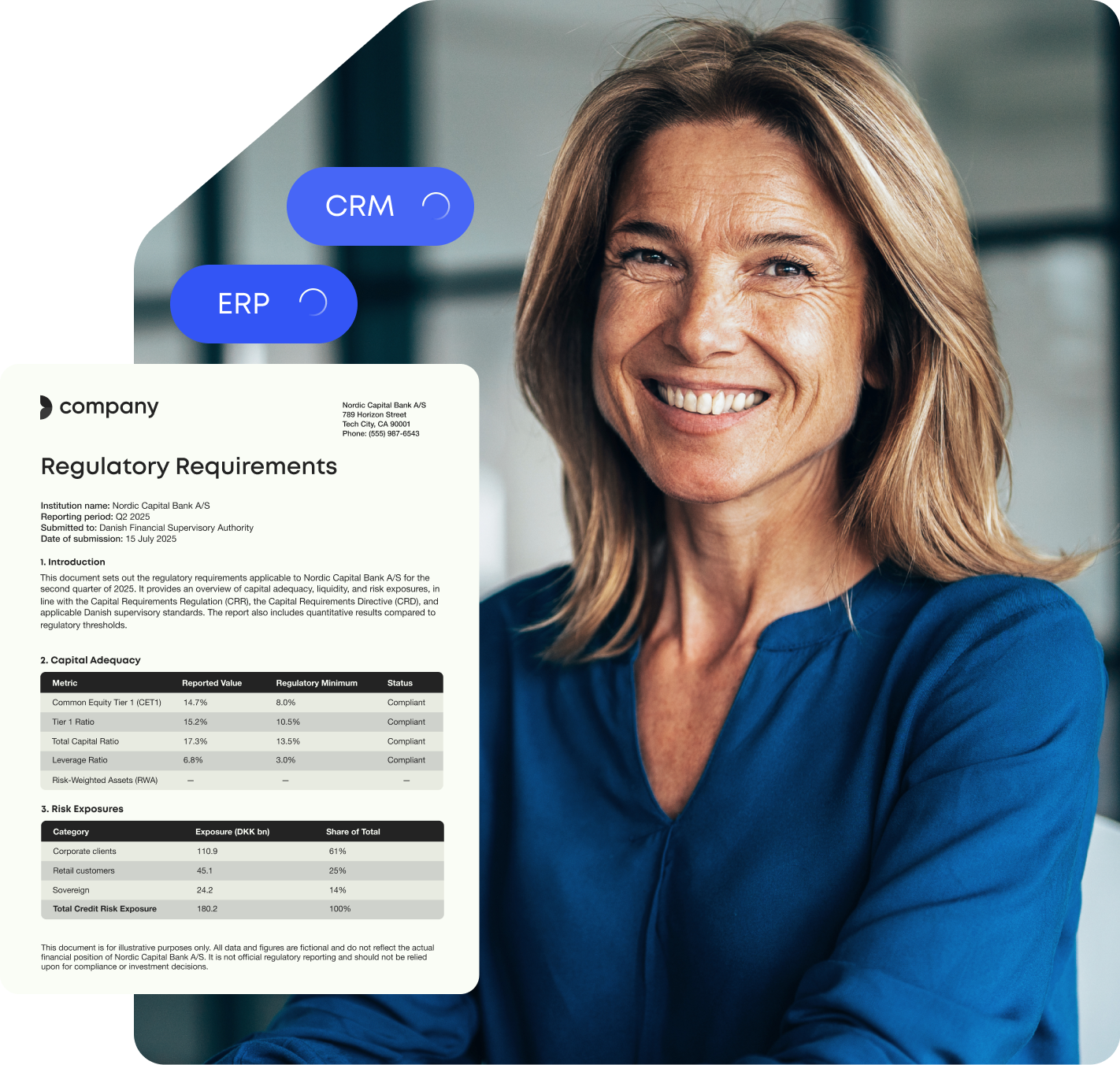

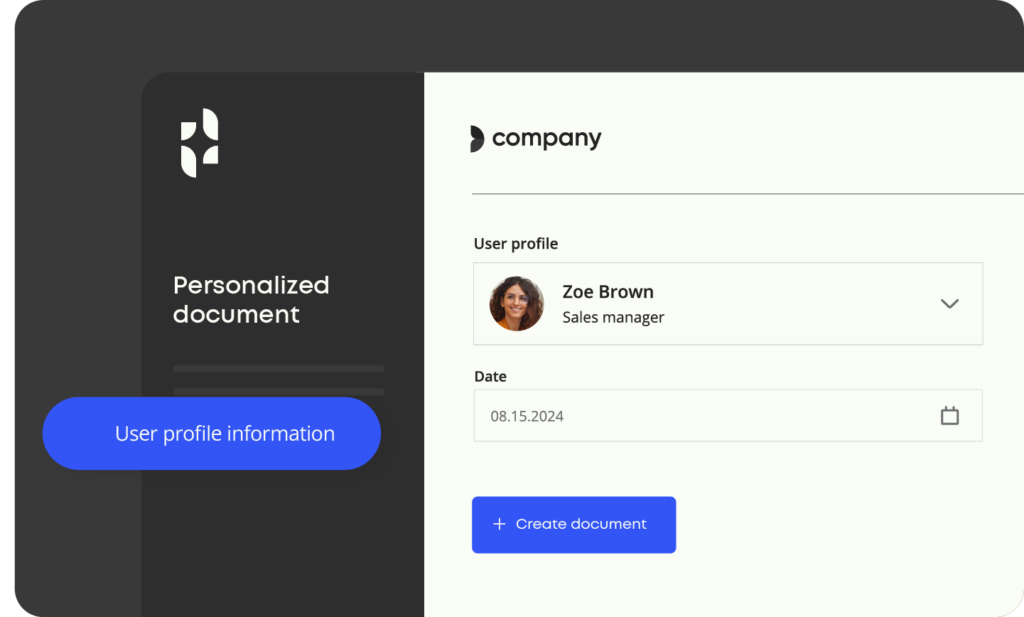

Automated data population

Connect directly to your ERP, CRM, and compliance systems to pull the right data directly into reports.

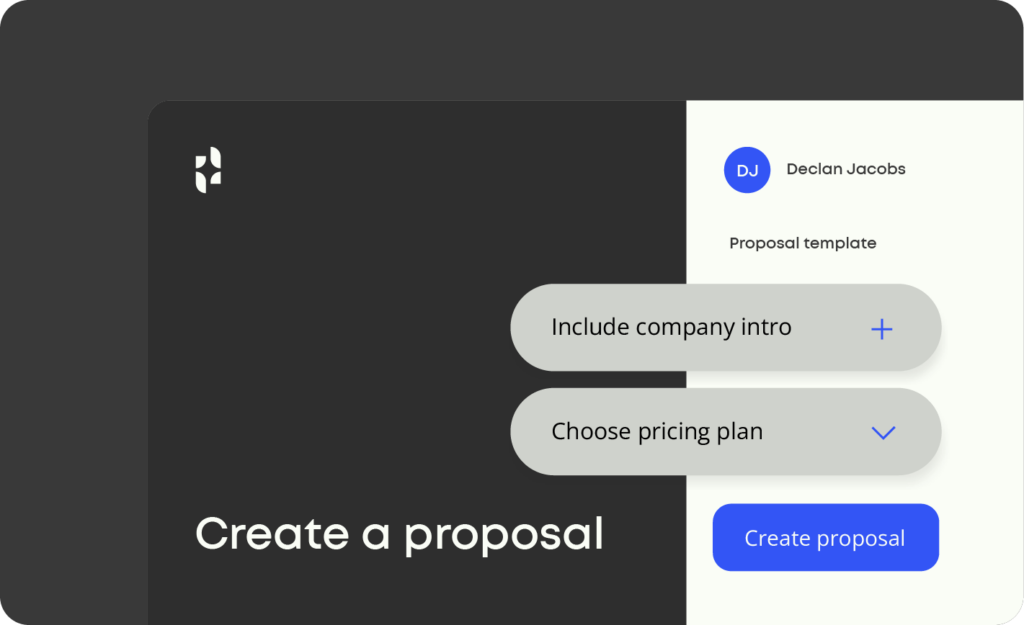

Rules-based automation

Route documents automatically for review and submission, with rules built to match your processes.

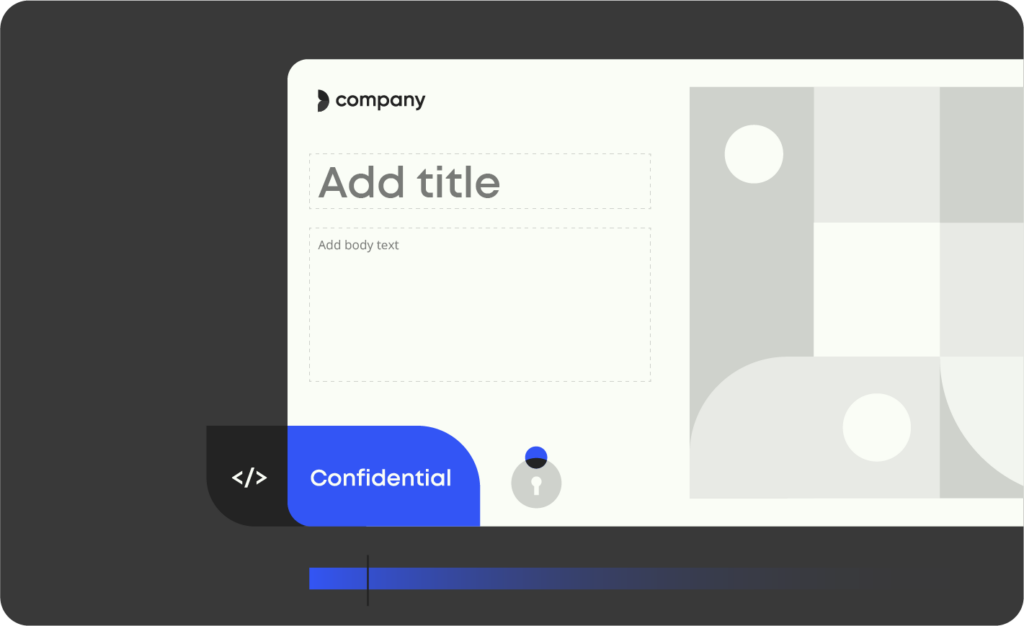

Compliance assurance

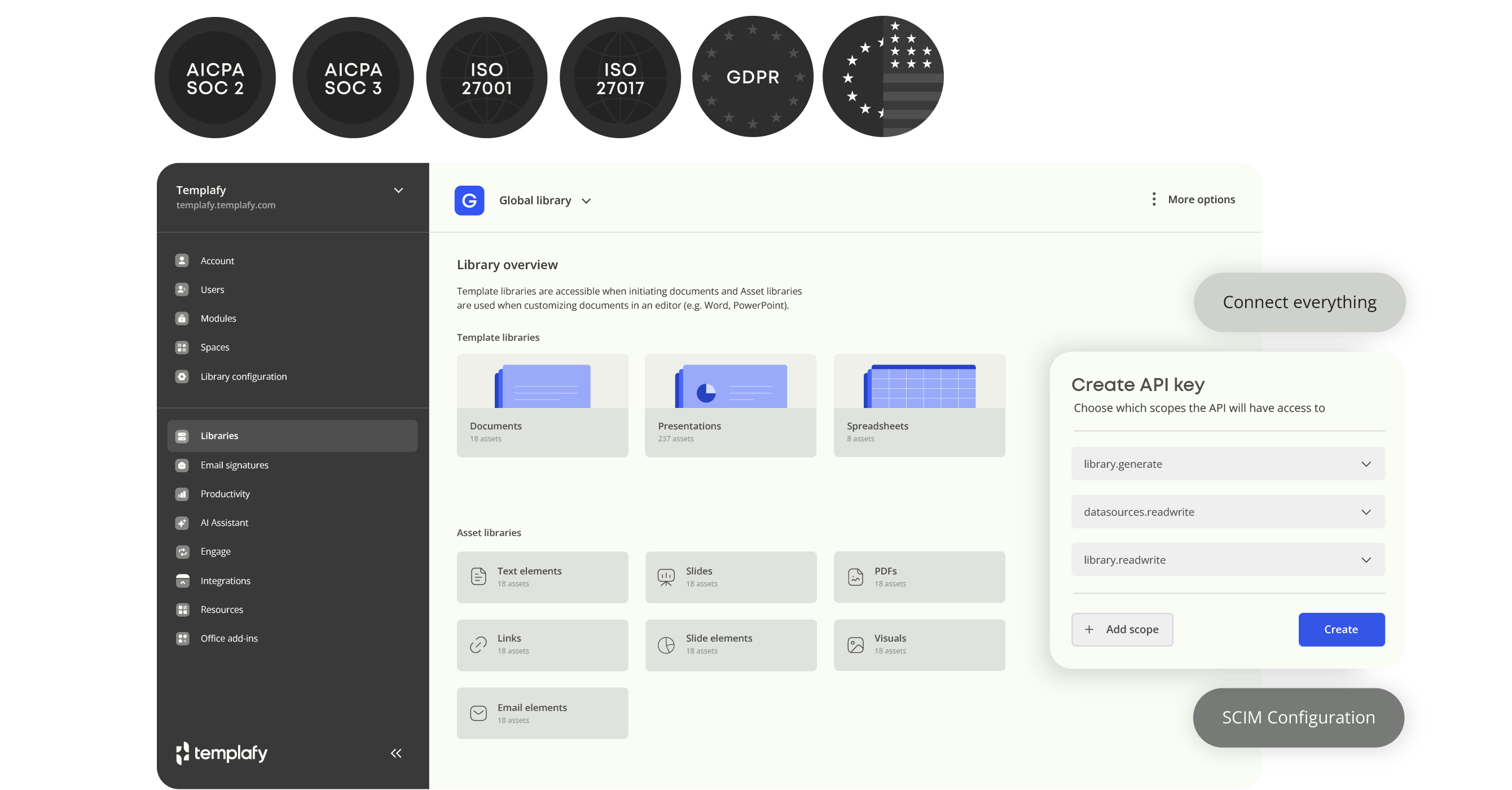

Every report includes an audit trail, backed by SOC 2, ISO 27001, and GDPR compliance.

Measuring the impact of automation

“For us, templates are not just a marketing advantage—they’re essential for maintaining efficiency and meeting mandatory requirements across all our operations.”

Stefan Truthän

Former CEO of hppberlin

Financial services

For banks, insurers, and investment firms, automation helps teams produce more accurate reports with less manual effort.

Corporate compliance

Global enterprises face overlapping rules. Automated reporting creates consistency across jurisdictions.

Global risk management

For high-risk industries that demand transparency, automation provides audit trails for full traceability.

Compliance starts with security

In regulated industries, protecting sensitive data is non-negotiable.

Templafy exceeds requirements, keeping every report secure and compliant. With enterprise-grade protection, we meet ISO 27001, SOC 2, SOC 3, GDPR, and Microsoft 365 certifications.

Additional resources

guide

AI for accounting firms

Explore how automation and AI are reshaping compliance and reporting processes.

calculator

The ROI of template management

See how enterprises achieve measurable efficiency and cost savings.

article

Banking compliance automation

Learn how automation reduces compliance risk in financial services.

article

Branding in financial services

Find out why strong brand governance matters for regulated industries.

Stop compliance risk at the source

Talk to an expert about how to eliminate manual errors in your regulatory reports.

Frequently asked questions

What is regulatory reporting automation?

The use of software to create, manage, and submit required compliance reports automatically. The goal is to reduce manual work while improving accuracy to make regulatory reporting more streamlined.

Why is automation important for financial reporting?

Financial services face strict guidelines which can change over time and may vary by region. Automation ensures reports stay compliant without requiring additional resources.

How is Templafy different from other RegTech platforms?

Other systems try to manage reporting end-to-end. Templafy focuses on the documents themselves and embeds compliance controls into every report so risks are caught early or prevented.

Does Templafy work with my existing systems?

Yes. Templafy integrates with tools like ERP, CRM, and compliance platforms to pull in correct data and keep workflows seamless.

How secure is regulatory reporting automation with Templafy?

Very secure. Reports are encrypted, access is role-based, and Templafy meets standards like ISO 27001, SOC 2, SOC 3, GDPR, and Microsoft 365 certification.

What role do templates play in compliance?

Centralized, compliant templates mean teams never risk using outdated or incorrect versions. Reports always reflect the latest regulations and company standards.