The best audit automation tools to reduce risk, save time, and boost ROI

How to make auditing faster and more accurate with automation and AI

Auditing has never been an easy job.

Almost by definition, it’s data-heavy, repetitive, and packed with paperwork—exactly the kind of job that AI and automation are built for.

The right software can take a huge chunk of the manual work off your audit team’s plate. But when accuracy, risk management, and compliance are on the line, choosing the right software isn’t easy. Pick the wrong tool and you could introduce new compliance risks and inefficiencies.

That’s why it’s important to understand what automation can (and can’t) do for internal audit teams.

In this blog, we share which tools deliver the best ROI, and how to stay in control of security, compliance, and quality at every stage.

What is audit automation?

Audit automation is software that performs repetitive auditing tasks, like collecting data, testing transactions, and generating reports, quickly and accurately. It’s designed to reduce manual effort and human error, helping auditors focus on analysis and insight while improving audit quality and compliance.

There’s a wide range of platforms on the market, but most are designed to help with these core tasks:

- Collecting and organizing data from multiple systems

- Creating and formatting audit reports

- Matching transactions and flagging inconsistencies

- Checking compliance against policies and regulations

- Maintaining a clear, traceable audit trail

These tools can’t replace auditors. The job still requires accountability, judgment, and professional scepticism. Instead, audit automation gives auditors the tools to deliver more reliable insights that help leaders make better decisions, faster.

How AI is changing audit automation

Audit automation has long been based on rules-based logic that follows a simple pattern: if X, then Y. This type of automation is still widely used today because it’s reliable and great for structured, repetitive tasks, like matching transactions or generating standard reports.

AI takes automation further. It can understand context, analyze entire datasets, and connect information across systems. For example, AI-powered audit tools can now generate reports in minutes using verified data, applying the right templates, and ensuring everything aligns with compliance standards before submission.

Can AI agents handle auditing for you?

AI is starting to act on its own. Agentic AI systems can now manage full workflows independently, compiling evidence, checking compliance, and summarizing findings without constant human input. Gartner predicts that by 2028, a third of enterprise software will include this kind of AI. (Gartner)

But these agents work best as digital sidekicks, not replacements. They take care of the structured, repetitive work that fills an auditor’s day, like document creation, data preparation, and organizing information from different sources. For audit teams, that leaves more time to focus on analysis, strategy, and judgment.

The smartest audit platforms bring both capabilities together. They use rules-based automation for precision combined with AI for flexibility, helping teams move faster while staying in control.

Why audit automation matters

Growing regulatory and workload pressure

When it comes to compliance, the only constant is change. Regulations are tightening, reporting demands are growing, and stakeholders expect more detail than ever. But most audit teams aren’t getting more people or bigger budgets to match.

That means they’re caught between two realities:

- More to audit: more data, tougher standards, higher expectations

- Fewer resources: smaller teams, tighter budgets, less time

It’s no wonder 59% of accountants admit to making several errors a month under heavy workloads (Gartner). Capacity limits are now an audit risk in themselves, and automation is essential just to keep pace.

The risks of manual audits

Manual auditing isn’t just slow, it’s risky. Even the sharpest eyes miss things after 10,000 rows of data. When teams rely on spreadsheets and repetitive processes, small oversights can turn into serious compliance problems.

The biggest risks are:

- Errors and inaccuracies from data entry mistakes or missing details

- Delays and bottlenecks caused by long review cycles

- Compliance gaps when checks are outdated or overlooked

- Hidden anomalies buried in huge datasets

- Reputational damage from mistakes that erode stakeholder trust

These problems aren’t rare; they happen every day in teams under pressure. Audit automation helps by giving teams more speed, accuracy, and control to stay ahead of risk.

Can AI agents handle auditing for you?

AI is starting to act on its own. Agentic AI systems can now manage full workflows independently, compiling evidence, checking compliance, and summarizing findings without constant human input. Gartner predicts that by 2028, a third of enterprise software will include this kind of AI. (Gartner)

But these agents work best as digital sidekicks, not replacements. They take care of the structured, repetitive work that fills an auditor’s day, like document creation, data preparation, and organizing information from different sources. For audit teams, that leaves more time to focus on analysis, strategy, and judgment.

The smartest audit platforms bring both capabilities together. They use rules-based automation for precision combined with AI for flexibility, helping teams move faster while staying in control.

audit automation

Where audit automation makes the biggest difference

- Document automation

- Data collection and preparation

- Risk assessment and anomaly detection

- Fraud detection and compliance monitoring

- Audit management systems

Work smarter with automation

Discover new ways to save time and reduce errors with document automation. See how teams use smart tools to work faster.

Every audit process has its pain points. From pulling data to formatting reports, there’s always a stage that eats up time, creates risk, or drains focus. That’s why modern audit automation tools now cover a range of functions, each built to solve a specific challenge.

Here are five key types of audit automation that make the biggest, fastest difference.

1. Document automation

If you’ve ever spent hours formatting a report, fixing wording, or chasing the “latest” template, you already know where audits bleed time—and where most errors (and reputational risk) creep in.

Document automation enables you to generate the documents you work with regularly: audit reports, engagement letters, management letters, planning memos, working papers, findings summaries, executive decks, and more.

The best platforms connect to internal data sources and content libraries to standardize templates and apply compliance language. That way, every document consistent and professional—no matter who creates it.

This means fewer copy-paste mistakes, faster turnaround, and complete confidence that every document meets legal, brand, and regulatory standards.

Tools to explore: Templafy, DocuSign CLM, PandaDoc, Conga Composer, Windward, HotDocs.

2. Data collection and preparation

Data preparation is one of the biggest time drains in auditing. Records come in from every direction (payroll systems, invoices, expense reports, spreadsheets) and pulling them together manually is slow, inconsistent, and error prone.

Modern automation tools fix this by gathering data directly from trusted sources like ERPs, CRMs, and accounting systems. They clean, validate, and structure it automatically, giving auditors standardized datasets from the start—instead of hours of manual wrangling.

The result is faster preparation, more reliable data, and more time for analysis instead of admin.

Tools to explore: MindBridge AI, KPMG Ignite, DataSnipper, Alteryx, CaseWare IDEA.

3. Risk assessment and anomaly detection

Traditional audits only test a fraction of transactions, which means unusual or high-risk items can slip through the cracks.

Today’s AI-driven analytics tools go further. They can review entire datasets in real time, flagging outliers, anomalies, and suspicious activity that manual sampling would miss. Some even identify emerging risk patterns, giving auditors a head start on potential issues before they escalate.

By scanning entire datasets, these tools reveal hidden risks and unusual patterns that manual sampling would miss.

Tools to explore: EY Helix, Deloitte Argus, Inflo, ACL Robotics, CaseWare AnalyticsAI.

4. Fraud detection and compliance monitoring

When fraud detection depends on manual review, it’s usually reactive. By the time an issue is found, the damage is often already done.

Now, continuous monitoring tools make it proactive. They track transactions and communications around the clock, comparing activity against internal policies and regulatory frameworks like SOX, ISO 27001, GDPR, and HIPAA. When irregularities appear, the system automatically alerts auditors, generates evidence, and logs a clear audit trail for review.

Continuous monitoring turns fraud detection from reactive to proactive, helping teams catch issues early and stay compliant year-round.

Tools to explore: ComplyAdvantage, IBM OpenPages with Watson, Workiva, Theta Lake, Oracle Risk Management Cloud.

5. Audit management systems

Audit management software is the glue that holds the entire process together. It centralizes planning, task assignments, documentation, and reporting—so every audit runs smoothly and nothing slips through the cracks.

For large or distributed teams juggling multiple engagements, these systems are essential. They provide real-time visibility into progress, risks, and findings, while integrating with analytics, workflow, and document automation tools for complete end-to-end oversight.

That way, everything stays on track. Teams collaborate more easily, accountability improves, and every audit moves confidently from planning to sign-off.

Tools to explore: AuditBoard, Wolters Kluwer TeamMate+, Galvanize HighBond, CaseWare Cloud, MetricStream.

Why documents are the smartest starting point for audit automation

Audit documents bring everything together: the data, the analysis, and the firm’s reputation. They’re also where small inconsistencies can quickly undermine compliance and client trust. Every engagement letter, audit report, and management summary needs to reflect current regulations, stay consistent across teams, and meet brand and disclosure standards.

Document automation tackles these challenges head-on. It replaces repetitive formatting and manual data entry with dynamic templates, approved content, and live data connections. The result is faster, more accurate, and fully compliant deliverables that auditors and clients can rely on.

The benefits of document automation for auditing

- Greater efficiency: Automate repetitive document tasks so teams can focus on analysis, not admin.

- Faster turnaround: Create audit-ready reports and supporting documents in a fraction of the time.

- Improved quality and accuracy: Eliminate formatting errors, version mismatches, and outdated language.

- Stronger compliance control: Ensure every report includes the latest regulatory and disclosure requirements.

- Consistent client experience: Deliver polished, on-brand documents across all offices and regions.

- Reduced risk exposure: Lower the chance of human error and compliance gaps in audit deliverables.

Why Templafy is the only audit automation platform you need

Templafy is so much more than an audit automation tool. It’s an AI-powered document automation platform that keeps every business document accurate, compliant, and on-brand—across every team, everywhere.

It connects people, data, and content inside the tools you already use to automate the documents that drive your business: proposals, contracts, audit reports, presentations, and more. For auditors, that means every engagement letter, management summary, and report is created using approved templates, live data, and firm-wide compliance language.

Templafy works directly inside Microsoft 365, so there’s no new apps to learn or maintain. It fits naturally into existing workflows, ensuring every document meets your firm’s standards the moment it’s created.

ADDITIONAL CONTENT

Embed AI where it matters most—your documents

Discover how Templafy’s document agents work inside Word, PowerPoint, Excel, and Copilot to keep every document accurate, compliant, and on-brand.

Why enterprises choose Templafy

There’s a reason more than 4 million professionals worldwide, including firms like KPMG, BDO, and EY, use Templafy. It’s built for organizations where accuracy, compliance, and brand integrity can’t be left to chance, and where every document represents the firm’s reputation.

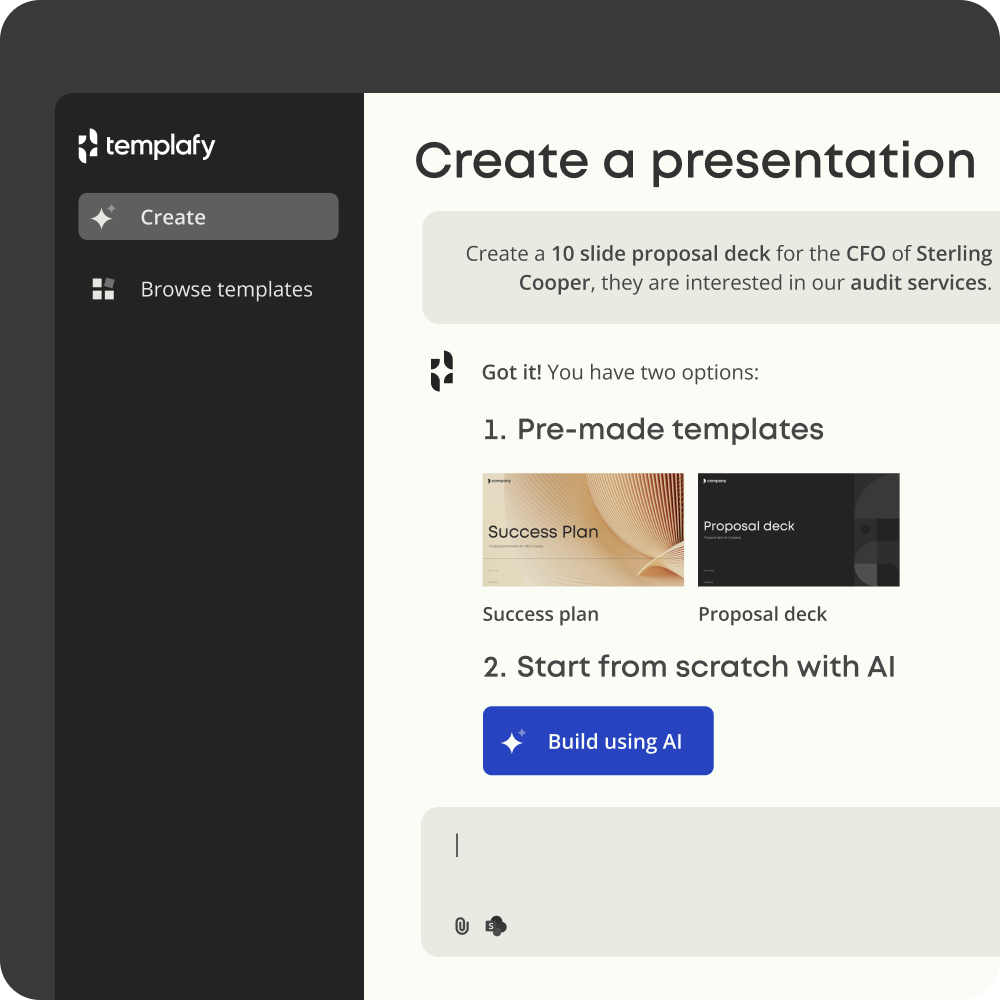

1. Document agents that build complete business documents for you

Templafy’s document agents are changing how enterprises use AI.

These AI-powered assistants work directly inside Microsoft 365, helping teams create accurate, compliant documents using simple, natural prompts. Type “Create an internal audit report for Q3 using client data from Dynamics” and within seconds, you’ll have a fully formatted, on-brand report with verified figures, current disclosures, and firm-approved content.

Unlike generic AI tools, Templafy’s document agents are built for enterprise documentation. They understand how business documents connect, from planning memos to final reports, and keep every version consistent. By pulling live data from CRMs, ERPs, and management systems, they remove manual entry and ensure every file reflects the latest, most reliable information.

The result is faster document creation, stronger compliance, and built-in control across every workflow.

Watch the video to see document agents in action.

2. Enterprise-grade governance and security

In auditing and beyond, data protection is non-negotiable. Templafy meets the highest industry standards with ISO 27001, SOC 2, SOC 3, and GDPR compliance. End-to-end encryption, granular access control, and detailed audit logs are built in. Admins define who can edit, approve, or share, and every action is traceable.

Read more about our security standards.

3. Risk assessment and anomaly detection

Whether your firm runs ten audits or ten thousand, Templafy keeps every document aligned with your governance and brand rules. Templates and legal language update automatically, so teams across regions always use the latest version.

4. Fraud detection and compliance monitoring

Templafy’s AI operates within administrator-defined boundaries. Every content source, tone of voice, and style rule is managed centrally, giving teams the freedom to move faster while maintaining complete compliance.

5. Audit management systems

Firms using Templafy report 3–4 hours saved per person each week on document work and 25% less time spent generating audit reports.

Read our customer cases for more proven results.

How to create audit documents with Templafy

Every audit engagement involves a flow of documentation, from kick-off to closure. Templafy supports that entire journey directly within your existing tools. Here’s how.

Start: Begin from anywhere

Auditors start wherever they create documents: Word, PowerPoint, Outlook, or their CRM. Templafy connects them all. Approved templates, disclosures, and brand assets are accessible in one place, so every document starts with the right version. Even Microsoft Copilot automatically uses Templafy templates to create brand-compliant reports and presentations.

Create: Build audit documents with AI and predefined rules

Templafy automates the creation of key audit deliverables like engagement letters, risk assessments, and management reports. It uses your firm’s approved templates and pulls live data from CRMs, RFP tools, and ERPs, producing accurate, personalized documents in minutes.

For example, an engagement letter can automatically populate with client details and compliance language, while an audit report can insert up-to-date results and disclosures without a single copy-paste.

Edit: Finalize with speed and confidence

With AI-assisted writing and rules-based formatting, editing becomes the easiest part. Templafy helps auditors summarize findings, check compliance language, translate content for international clients, and improve clarity—all within Microsoft 365.

Deliver: Share securely and stay in control

Once finalized, teams can export documents in any format (Word, PowerPoint, Excel, or PDF) and send them directly to clients or partners. Each version is logged and stored in connected systems like your CRM or DMS, maintaining version history and full audit traceability.

To explore how these integrations connect across enterprise ecosystems, visit Templafy Integrations.

Proven results from leading firms

BDO Canada

At BDO Canada, consistency and quality were non-negotiable. With hundreds of auditors working across multiple offices, ensuring every report met the firm’s high standards was becoming a constant challenge. Templates were often outdated, formatting varied between teams, and maintaining compliance wording across reports took valuable time away from client work.

Templafy provided a single, centralized system for creating and managing all audit deliverables. Every document, from engagement letters to management reports, now starts from a controlled template within Microsoft Office. Compliance language, disclosures, and brand elements are pre-approved and automatically applied.

The results were immediate. BDO generated more than 120,000 documents through Templafy, saving an estimated $1.65 million in time. Reports are now consistent across all practice areas, and auditors can focus on strategic analysis rather than document formatting.

“At BDO, the quality and consistency of the documents we deliver to our clients is non-negotiable. Using Templafy to streamline that process assures quality and allows our team to spend more time building client relationships.”

— Brion Hendry, Partner and Assurance Innovation Leader, BDO Canada

iComm

For iComm, preparing client proposals was eating into valuable time. Each proposal took around four hours to complete, with teams manually updating branding, formatting slides, and pulling in content from multiple sources.

After implementing Templafy, the process changed completely. Teams could generate fully formatted proposals in Microsoft Office using document agents that automatically inserted the latest brand assets and client data.

The results spoke for themselves: proposal creation times dropped by 92%, from four hours to just twenty minutes. Consultants reclaimed over 70% of their preparation time, using it to focus on clients and strategy instead of formatting. Win rates also increased thanks to faster delivery and a more professional final product.

“Templafy has helped us reduce our proposal creation from four hours down to twenty minutes.”

— Justin O’Meara, Unified Communications Consultant, iComm

More on AI agents

Learn more about Templafy’s document agents in our webinar series. Register for upcoming sessions or watch on demand.

5 best practices for secure audit automation

For enterprise organizations, control isn’t optional. Any new AI or automation tool has to meet strict standards for security, compliance, and governance so it doesn’t compromise accuracy, brand integrity, or client trust.

As automation becomes central to how work gets done, the goal isn’t just to move faster. It’s to stay consistent, compliant, and in control at every scale. Here’s what to look for in a platform that does exactly that, and how Templafy delivers.

1. Start with enterprise control

Automation should strengthen governance, not bypass it. Choose a platform where administrators can set clear rules for templates, approvals, and content sources. That’s how teams get freedom to move quickly while staying within compliance boundaries.

With Templafy, administrators define every rule, from document styling to language use, so every document meets brand and regulatory standards before it’s even sent.

2. Make security non-negotiable

Enterprise documents contain highly sensitive data, which means security must be built in from the start. Look for platforms certified under frameworks like ISO, SOC, and GDPR, with encryption, access controls, and full audit trails as standard.

Templafy meets all of these requirements and more. It protects company and client data with enterprise-grade security, real-time monitoring, and transparent oversight.

3. Choose tools that fit into your ecosystem

Automation should fit your existing processes, not force new ones. The right system works inside familiar tools like Microsoft 365, SharePoint, and your ERP and CRM platforms, keeping workflows consistent and connected.

Templafy integrates seamlessly with these systems, pulling real-time data into documents automatically and reducing manual entry errors.

4. Measure efficiency where it matters

The real test of automation is its impact. You should see faster document creation, fewer review cycles, and less time spent on admin work. It’s about removing friction, not adding dashboards.

Templafy helps teams achieve that immediately, cutting time spent on document creation and review while maintaining accuracy and compliance.

5. Keep governance front and center as AI evolves

AI can transform how enterprises operate, but it needs clear boundaries. Choose a platform that lets administrators decide which models are used, what data they access, and how outputs are validated.

Templafy’s document agents do exactly that. They bring AI into document workflows responsibly, combining automation with strong enterprise governance and oversight.

Ready to transform your audits with Templafy?

The only way to see what’s possible is to experience Templafy for yourself.

Join our experts for a walk-through and see how AI-powered document automation can help audit teams create accurate, compliant, and on-brand documents, all from inside Microsoft 365.