How automation can improve insurance policy management

Explore the tools that are helping automate critical insurance workflows

Insurance is designed to give customers peace of mind. But if those customers knew how their insurance policies were typically managed, they might not feel so calm. For many insurers, outdated systems and manual workflows make things slower and more complicated than they need to be. In a business built on precision and trust, even small errors can cause compliance headaches and customer frustration.

Modern insurance policy management changes that. By combining automation, compliance tools, and connected systems, insurers can turn complex, document-heavy processes into smooth, auditable workflows. We’ll look at what insurance policy management is, how software and automation simplify the policy lifecycle, and why forward-thinking insurers are investing in new solutions to automate the busywork.

What is insurance policy management?

Insurance policy management is the process of creating, issuing, maintaining, and updating insurance policies throughout their lifecycle. It includes everything from drafting policy documents and handling endorsements to managing renewals, cancellations, and compliance checks.

Strong policy management keeps insurers efficient and customers protected. When processes run smoothly, policies are accurate, up to date, and easy to access—reducing errors that can lead to compliance issues or poor customer experiences. It also helps insurers respond faster to market changes and regulatory updates.

Traditional policy management often relies on manual data entry and disconnected systems, which makes it slow and error prone. Modernizing this process with digital tools and automation helps insurers reduce administrative work and deliver a more consistent experience for both employees and policyholders.

Inside the insurance policy lifecycle

Work smarter with automation

Discover new ways to save time and reduce errors with document automation. See how teams use smart tools to work faster.

Every insurance policy follows a structured lifecycle. Here’s how it typically unfolds:

Policy creation and issuance

The lifecycle begins with data collection, underwriting, and document generation. Policy details are drafted and issued to the customer. Accuracy and speed are critical here as errors at this stage can ripple through the entire process.

Endorsements, amendments, and mid-term adjustments

Once active, policies often require updates. These can include coverage changes, address updates, or adjustments to premiums or terms. Managing these edits efficiently ensures transparency and maintains compliance with both internal and regulatory standards.

Renewals and cancellations

As policies near expiration, renewal notices, updated terms, or cancellation options must be handled promptly. Automated reminders and pre-approved templates streamline this step, improving retention and customer experience.

Regulatory compliance checkpoints

At every phase, policies must align with industry regulations, internal governance, and audit requirements. Automating these checkpoints reduces compliance risk and ensures all documentation remains accurate and traceable.

The tech behind better policy management

An insurance policy management system is a digital platform that helps insurers manage the full policy lifecycle. It provides one connected system where teams can work together for maximum accuracy, speed, and regulatory alignment. Here are some key features to consider when assessing a new platform.

| Key feature | What it does | Why it matters |

|---|---|---|

| Automation | Streamlines policy creation, updates, and renewals through pre-approved templates and workflows. | • Reduces human error and saves time. • Ensures consistent policy documents across teams. |

| Compliance | Tracks regulations, applies correct clauses, and maintains audit trails automatically. | • Keeps every policy aligned with industry standards. • Ensures audit readiness at any time. |

| Integrations | Connects with CRM, ERP, and document systems to share real-time data. | • Improves accuracy and efficiency. • Eliminates duplicate data entry. • Creates a single source of truth. |

| Scalability | Supports growing volumes of policies and users across regions. | • Enables insurers to expand confidently. • Maintains control and compliance at scale. |

What to look for in great policy management software

Good policy management software helps insurers automate repeat tasks, enforce rules, and give staff and customers a smooth experience. When evaluating software, look for capabilities across three key areas:

Automation

- Enables prebuilt workflows for policy creation, renewal, endorsements, and approvals.

- Reduces repetitive data entry by pulling information directly from integrated systems.

- Speeds up cycle times and ensures every policy follows a consistent process from start to finish.

Compliance

- Embeds built-in rules, audit trails, and real-time regulatory checks.

- Alerts users to missing clauses or outdated terms before documents are issued.

- Keeps every version traceable, ensuring policies are always audit-ready and aligned with evolving standards.

User experience

- Offers intuitive dashboards and role-based views so teams can work efficiently without extensive training.

- Provides clear visibility into policy status, pending actions, and compliance flags.

- Improves collaboration between underwriting, operations, and compliance teams through a unified interface.

Outsource it or automate it? The smarter long-term strategy

For years, many insurers have turned to outsourcing as a way to handle the time-consuming tasks of policy administration like data entry, document creation, renewals, and customer updates.

Outsourcing can reduce short-term costs and let internal teams focus more on customer communication and strategic initiatives. But it also introduces new challenges: limited control over data accuracy, slower turnaround times, and higher compliance risks when third parties handle sensitive information. Communication gaps and inconsistent document quality can also hurt the customer experience.

Automation offers a smarter and safer alternative. By digitizing and streamlining policy management workflows, insurers can keep full control of their data while reducing manual effort.

Automated templates, real-time compliance checks, and integrated approval workflows make it faster and easier to issue accurate, compliant policies. Unlike outsourcing, automation improves continuously as systems learn and scale with the business without adding headcount or risking confidentiality.

From a cost and compliance perspective, automation delivers stronger long-term returns. It cuts repetitive tasks that drive operational costs, maintains consistent policy language, and ensures every document meets regulatory standards.

In short, outsourcing may fill temporary capacity gaps, but automation builds lasting efficiency and compliance from within.

Additional content

Moving from manual to automated document creation

What to consider when upgrading to an automated document management system.

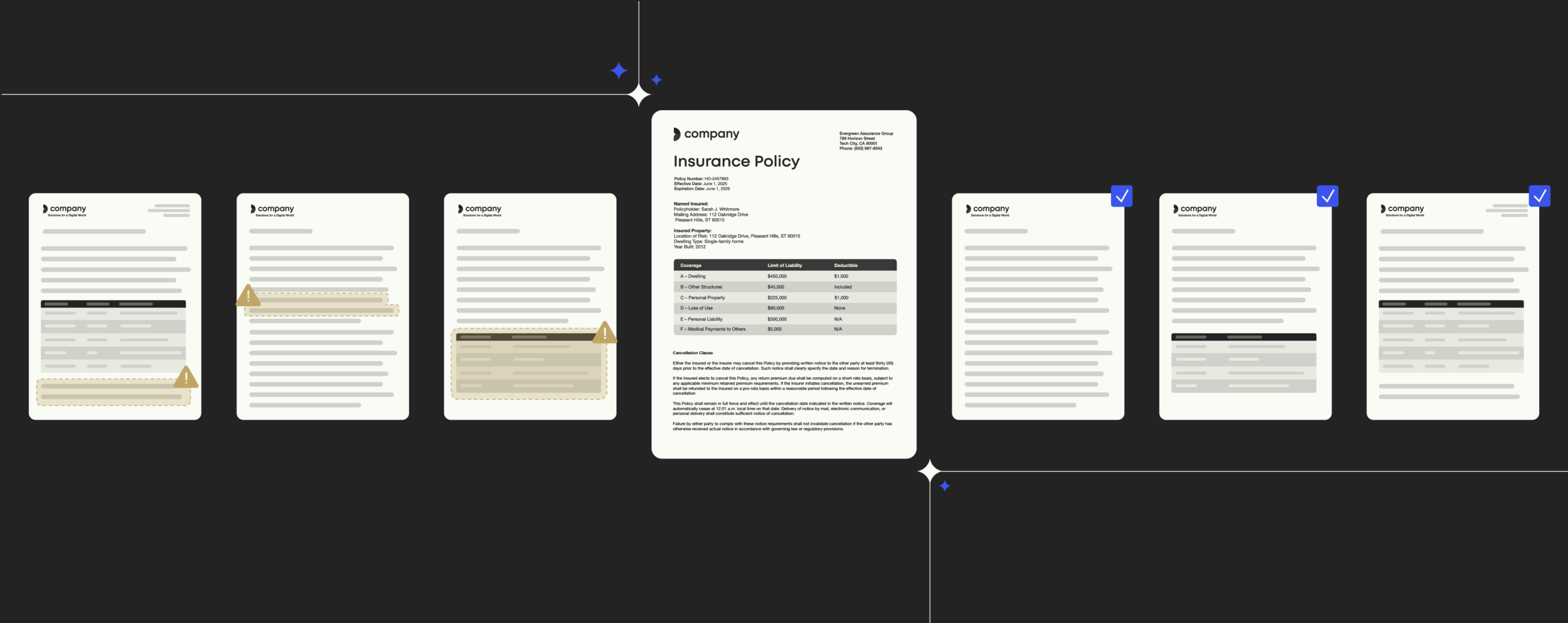

Policy management automation in action

Automation improves compliance by embedding rules, validations, and audit logs directly into workflows. These workflows can automatically block invalid changes, trigger alerts when coverage limits are breached, and maintain a complete version history of every document. This removes the need for manual checks that can miss clauses or deadlines and strengthens defensibility during audits or regulatory reviews.

Across the industry, insurers are already seeing measurable gains. Many are using robotic process automation (RPA) to handle endorsements and mid-term changes, automatically updating policy terms and maintaining a full audit trail. Others are combining AI and process mining to cut processing times, identify anomalies early, and improve decision-making across policy lifecycles.

Document automation plays a central role in this transformation. With Templafy, insurers can automatically generate policies, endorsements, and renewals from approved templates that pull in real-time data from a centralized library. Updates to regulations or branding are instantly applied to every document, ensuring consistency and faster turnaround across regions.

Checklist: Best practices for effective policy management

Align people, processes, and technology

- Define clear roles for every team involved in policy administration.

- Map and document workflows so everyone follows the same steps.

- Connect your policy system with core platforms like CRM, ERP, and claims tools to eliminate silos.

- Provide ongoing training to keep teams confident using new digital tools.

Prioritize compliance and audit readiness

- Build compliance checkpoints directly into your workflows.

- Use version control and audit trails to track every document change.

- Schedule regular internal reviews to ensure policies match current regulations.

- Centralize approved templates and clauses to prevent inconsistent or outdated language.

Prepare for scalability and growth

- Choose systems that can handle increased policy volumes and multiple regions.

- Automate repetitive processes like renewals and notifications to free up resources.

- Monitor performance metrics to identify bottlenecks before they slow you down.

- Regularly review and update workflows to support new products, regulations, or markets.

CUSTOMER CASE: IF P&C INSURANCE

If P&C Insurance: A blueprint for smarter document workflows

If P&C Insurance, one of the Nordic region’s largest insurers, faced a common challenge: managing complex document workflows across multiple countries while maintaining consistency and compliance. Employees were spending large portions of their time formatting documents and chasing down the latest templates.

With Templafy, If P&C was able to centralize all templates and automate data integration directly into documents. This meant every employee could quickly generate fully compliant documents without manual edits or guesswork.

Key results:

- Unified templates that ensure brand and compliance alignment across regions

- Greater efficiency and time savings by eliminating manual document handling

- Better customer focus and improved service delivery

The future of insurance policy management

AI and intelligent automation are already making policy management smarter and more intuitive. Emerging tools can detect risk patterns, generate compliant documents instantly, and adapt to regulatory changes in real time.

Insurers that modernize now will gain the ability to launch products faster and strengthen customer trust. The future belongs to insurers who treat automation not as a project, but as a core capability powering efficiency, compliance, and innovation.

See how automation transforms policy management

Book a demo with Templafy to discover how leading insurers cut manual work, boost compliance, and deliver policies faster, all from one connected platform.