Being an insurance company in today’s market isn’t easy. Those operating in one of the most highly regulated industries know all too well that buying insurance doesn’t usually excite the consumer. You don’t find people talking about choosing between Geico and Liberty Mutual or Ping An and China Life in the same way they deliberate over buying a Google Pixel or iPhone X. Skepticism, indifference and distrust have traditionally been much more likely consumer attitudes towards insurance companies.

Yet, homeowners insurance, car insurance, life insurance and the like, are must-have financial services covering just about every area of our lives. This abundance of opportunities makes the market extremely competitive, with major players contributing to the industry’s billions of dollars spent on advertising. And it’s not just traditional insurance companies that are fighting for consumer attention. According to a recent HBR global survey, more than 65% of customers said they would think seriously about buying insurance products from non-insurers, with 23% opting to go totally digital, purchasing insurance from Google or Amazon-like online providers on mobile apps instead.

Read how Templafy helps companies with their corporate branding and brand management

This is why branding insurance firms is so important. At the moment of purchase, it pays to be the first brand a consumer thinks of. Insurance brands have to stand out in their category - not just to be memorable, but also to combat a legacy of negative consumer perceptions. By creating a brand which evokes positive policyholder sentiments, insurance companies can build new, lucrative relationships with customers, using a consistent brand experience and strong brand governance to counter trust issues previously inherent within the market.

In this next edition of our Industry Branding series, we take a look at the branding of leading insurance firms, taking stock of how their tricks of the trade are changing the sector, and providing lessons for any firm looking to boost business and increase brand value through their brand world.

Branding insurance firms case study #1: Hi Oscar…

Since launching in 2012, New York-based health insurer Oscar Health has caused quite a stir in the market. Promising a new kind of healthcare, the company’s mission “to make buying health insurance easier, more transparent and to provide better customer service” came about after co-founder Josh Kushner hurt his ankle and was presented with a typically complex and incomprehensible insurance bill.

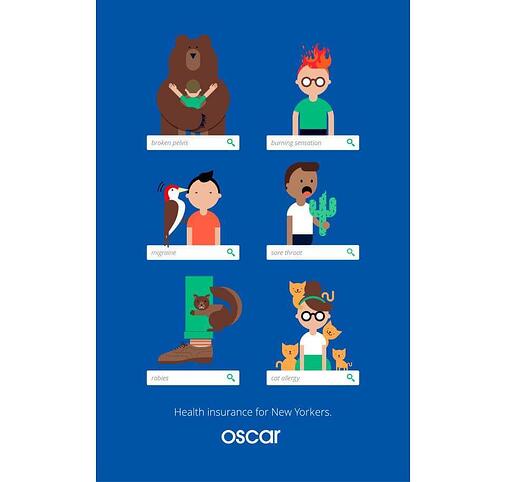

The personal experience inspired Kushner and his team to launch a range of simple healthcare plans, using a refreshingly friendly, simplistic and conversational healthcare brand to communicate their offering. Speaking of the Oscar brand in a recent interview, Kushner commented: “We created a brand personality that’s friendly, human, approachable, and focused on the individual… We keep our member experiences clean, simple, and easy to navigate.”

As one journalist rightly put it, “Oscar does not look, feel, or speak like other health insurance brands.” Oscar’s take on branding insurance firms is unlike anything the industry had ever seen before. For instance, their tagline ‘Hi, We’re Oscar’ for example, immediately communicates the company’s simple, friendly persona. The brand look, often referred to as ‘millennial-friendly,’ is characterized by fresh, contemporary, digitally-optimized and once again simple visuals that use bold colors, illustration, and emoji-like characters. Everything you see from Oscar is fun, easy to digest and simplistic, differentiating it from any other player in the category while boosting its unique brand values and mission.

Using clever branding to differentiate from their competitors has certainly worked for Oscar. In August 2018 its reported gross premium revenue totalled $630 million, with net profit reaching $5 million. It was named #12 on CNBC’s Disruptor List and had industry figures penning articles titles: “Why badass brands like Oscar Health win” and “Is Oscar the world’s most innovative Health Insurance brand?”

Since then, Oscar’s brand strength has continued to carry them to new heights. In 2021, it posted a gross premium revenue topping $6.1 billion. The insurance brand (as a disruptor) is what attracts new policyholders and enhances investor relations. The simple, clean, and effective insurance policies and underwriting are what keeps them coming back.

Branding insurance firms takeout: Use insights to brand differently

Kushner’s direct personal experience sparked the idea for an industry-changing business, but a trip to A&E or scouring annual reports isn’t always necessary for the same level of insights into your sector. Understanding how your competitors are behaving, how they are communicating and what they look like, should be your starting point for creating a look and feel that’s new and attention-grabbing.

Oscar is also the perfect example of how all branding should line up. Your tagline should come across in your visuals, your newsletter copy should mirror the tone used in your ‘contact us’ form, and your brand color palette should be used throughout all communications. Automation tools are your secret weapon for ensuring smooth brand world roll-out, effective brand governance and making sure your brand experience is a consistent one.

Branding insurance firms case study #2: Branding with vitality

Consumer electronics, fashion, automotive and sports brands thrive on passionate, emotive and positive branding to inspire head-over-heart purchase decisions. Think Nike, Apple, Burberry, and Mercedes-Benz, who are iconic heavyweights in this area.

On the flip side, branding insurance firms is often about prudence and calculation or risk vs. reward, with marketing communications focusing on a more negative approach of the numbers, the cost vs. return and the ‘what if?’ to encourage consumers to make the sensible, rational decision to take out a policy for peace of mind.

Like Oscar, in the insurance industry, we’re starting to see this old world challenged by a new wave of branding. Insurance brands are taking a different approach by swapping ‘what if?’ scenarios with a more positive brand purpose.

Vitality Health Insurance in the UK has ditched the industry’s go-to tactic of peddling the fear of getting sick by actively helping their policyholders to stay healthy. Supporting a brand positioning about good health and wellbeing, Vitality sponsors a major 10km run in London, partners with athletes and sportspeople and has invested in smart watches and biosensors to empower the individual to take control of their health through the tracking and improvement of their health with data. All of which makes bold use of their brand identity and colors.

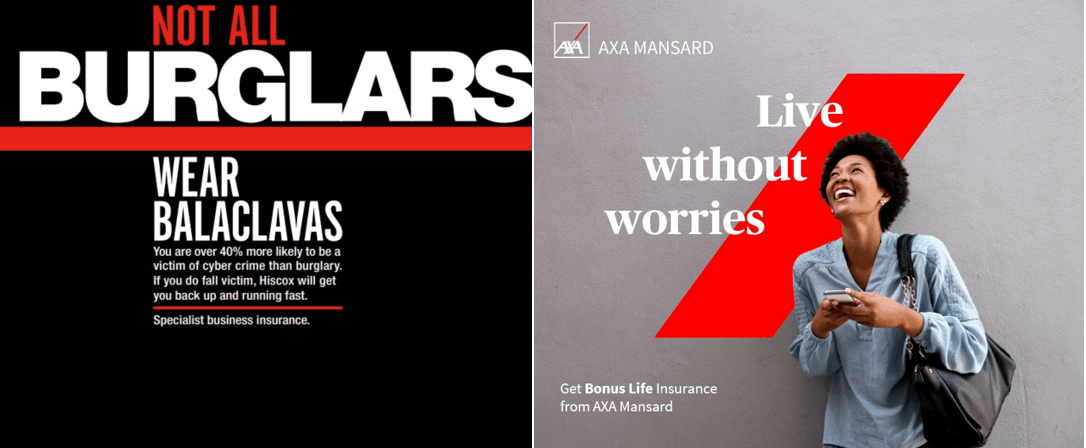

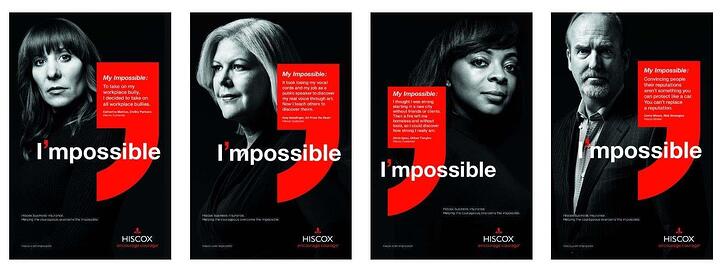

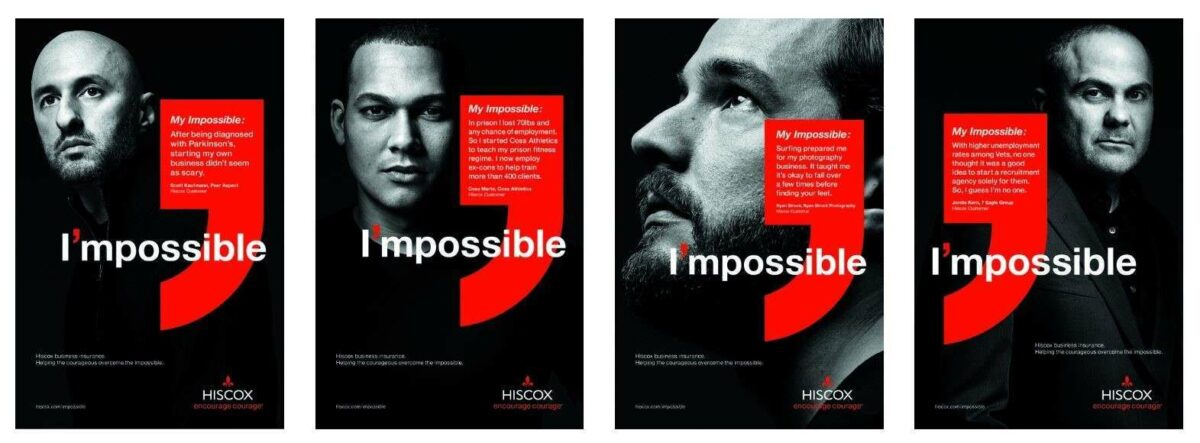

Hiscox Business Insurance joins Vitality in this new wave of positive branding insurance firms approach. The business insurer has changed tact to hero their customers, not for their prudent policy purchases, but for their courage and conviction in starting their own small businesses and champions their bravery in taking that risk.

Using the bold red, white and black colors of their logo, they have created distinctly Hiscox adverts that instill confidence not fear, with the aim to motivate more people to feel like they have what it takes to follow these footsteps.

Branding insurance firms takeout: Have a purpose

Nowadays, consumers buy insurance brands with purpose. Be brave and look past the offer, the insurance product or the incentive and stand for something bigger. Use your branding to move your customers with the positive and appeal to the heart over the head to change the way they feel towards buying insurance.

Executed perfectly by Vitality and Hiscox, insurance brands are also making smart use of their brand color palette across all communications, so once again a consistent and memorable brand experience is delivered to existing and potential customers.

Branding insurance firms case study #3: What If...

Just as emotive, brand-led communications can put you in the forefront of the consumer’s mind and smart brand positioning can disrupt a whole industry; poor brand governance and an inconsistent brand experience can undo all that hard, expensive work.

It all boils down to trust - a contentious issue in the insurance industry. 43% of Americans don’t trust insurance companies in general, while only half of British consumers trust their insurers to pay their claims. It’s safe to say modern day insurance companies have their work cut out for them to change the tides in popular opinion. So delivering a consistent brand experience is paramount. If your branding is all about speedy claim settlement, and there’s a Twitter feed full of disgruntled customers fed up of waiting for their claim to be processed, your brand identity and value is instantly discredited.

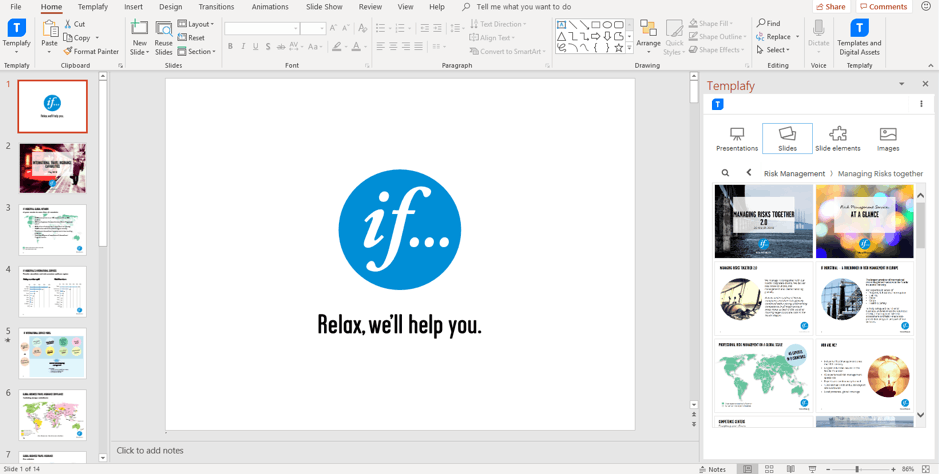

With trust and consistency inextricably linked, the brand consistency of your visuals needs to be a priority - from logo to font, color palette and email sign off. A business that brands itself as an insurance company for the digital age but has an email signature that won’t load, or a firm claiming to move with the times but sends out a policy document with its own old logo inevitably causes confusion and distrust. That’s why companies who invest in the internal implementation of their branding, like If P&C Insurance Ltd, are successful in their sector.

If P&C Insurance, a leading property and casualty insurer in the Nordic and Baltic regions, has over 6,500 employees based in 11 countries, delivering services for around 3.7 million customers. As a growing global brand, the company became aware of the challenges of coordinating a brand world across multiple offices. Marketing Project Manager, Anna Andersson-Solja recalls: “every country, and even units within the same country had their own preference for how documents should look, which didn’t necessarily follow the company’s visual brand identity and guidelines.”

Creating on-brand documents was also a tedious process. Branding of key documents, such as insurance terms and conditions, had to be outsourced to production agencies. These external production agencies would then send back individual PDF documents to the employees, which was not an ideal process in terms of time or cost when changes had to be made.

Using Templafy’s document and brand management solutions, If was able to cater for its different offices and customer needs through a centralized system, with on-brand documents easily created using dynamic templates and content libraries. Hosted via the cloud, all pre-approved content was accessible to an If employee through their personal dashboard, so no matter where they were in the world they were or what time zone they were working in, they could create, manage and send on-brand pre-populated, customizable documents to their clients and internal team.

The result is that If's customer will always receive an authentic brand experience - from website to claims forms, social media posts and renewal letters. If employees can also focus on delivering excellent service, resting assured that they’re always delivering on-brand communications without constantly checking the latest style guides or searching for brand-approved digital assets. Brand management is instantly simplified.

Branding insurance firms: Make branding easy for your employees

Brands need to look beyond the big ad campaigns and start by ensuring correct branding is taking place within office walls. Your employees are your most effective brand ambassadors. They are the people that will be communicating on a daily basis with your policyholders, executing your brand world. If they don’t have the knowledge and tools they need to implement your brand world, your brand value and consistency are at risk.

Document automation tools, such as Templafy, safeguard against issues of brand integrity, providing end-to-end solutions to ensure your new brand identity is rolled out and maintained as intended across all communications. Freeing up your team’s time to grow the business, increase productivity and sell your brand.

If you’d like to learn more about how Templafy can help those manage branding insurance firms, get in touch.